Dans un monde où chaque choix compte, Meobank aide les utilisateurs à prendre des décisions financières qui contribuent à un avenir plus vert.

A personalized banking experience for young adults

Empowering users to make financial decisions that align with their environmental values is at the core of Meobank’s mission

Dans un monde où chaque choix compte, Meobank aide les utilisateurs à prendre des décisions financières qui contribuent à un avenir plus vert.

My role

En tant que **Designer UX/UI** sur ce projet, mes responsabilités incluent :

→ **Recherche Utilisateur & Personas** : Conduire des recherches utilisateur et créer des personas détaillés pour comprendre les besoins et les motivations.

→ Wireframing and Prototyping

→ Information Architecture

→ User Testing

→ Journey Mapping

→ Web & Mobile Design

→ Responsive Design

→ Accessibility

→ Design Systems

→ Visual Design & Branding

Project

The essentials of banking

WezBank is a banking application designed to simplify the financial management of young adults, especially those who share expenses with friends or young colleagues, whether in shared housing, during outings with friends, on trips, or for those just starting to manage their finances.

WezBank’s goal is not only to meet these immediate needs but also to grow with its users by constantly offering solutions tailored to each stage of their financial lives. The application evolves with them, providing simple, fast, customizable, and secure features that accompany them as their needs change. WezBank aims to become a comprehensive solution capable of addressing increasingly diverse financial needs throughout its users’ lives.

My role

User interface design

-

Creating high-fidelity mockups by defining the color palette, typography, and graphic elements to ensure a coherent and attractive interface.

-

Developing the visual identity of the application to reflect the values of simplicity and friendliness.

As the lead UI designer, I was responsible for designing the user interface and developing a smooth experience that met the expectations of the target users.

My role included the following:

Interactive prototyping

-

Developing interactive prototypes to simulate the user experience and allow for preliminary testing.

-

Creating smooth transitions and animations.

Multidisciplinary collaboration

-

Working closely with the UX team to integrate user needs into the visual design.

-

Collaborating with developers to ensure the design is technically feasible and optimized for various platforms.

Testing and iterations

-

Organizing and conducting user tests to evaluate the developed prototypes.

-

These sessions will gather and analyze valuable feedback from users, allowing for necessary iterations to continuously improve the user experience.

Documentation

-

Creating a comprehensive style guide to ensure visual consistency throughout development.

-

Providing resources and assets to developers to facilitate design integration.

Challenges

Security

Young users place significant importance on the security of their online payments. To address this concern, we implemented advanced protection mechanisms, ensuring enhanced security against fraud. These measures help strengthen users’ confidence in managing their finances by providing a secure and reliable environment.

Optimization for speed

Ensuring that visual elements do not hinder the application’s performance, especially on less powerful devices often used by students.

Market differentiation

In an extremely competitive banking market, the main challenge was to make WezBank unique and instantly recognizable. To stand out from other digital banks, WezBank focused on simplicity, flexibility, and personalization while integrating innovative features. The application’s modern and accessible aesthetic was carefully crafted to meet the expectations of young adults, thereby reinforcing its distinctive and appealing character.

Goals

Creating an intuitive application

Designing a simple and smooth navigation to facilitate ease of use in financial decisions.

Alignment with sustainability

Reflecting Meobank’s values by integrating eco-friendly features at every level of interaction.

Security and modernity

Providing a modern, simple, and secure interface that inspires trust.

Helping users anticipate and make proactive financial choices.

Goals

Creating an intuitive application

Designing a simple and smooth navigation to facilitate ease of use in financial decisions.

Security and modernity

Providing a modern, simple, and secure interface that inspires trust.

Alignment with sustainability

Reflecting Meobank’s values by integrating eco-friendly features at every level of interaction.

Goals

The primary goal of this project is to design a banking application that is both intuitive and emotionally engaging, aligned with Meobank’s core values of sustainability and responsibility. We aim to create a user experience (UX) that is welcoming and easy to navigate, paired with a modern, simple, and secure user interface (UI). The ultimate objective is to ensure that every interaction with the app strengthens users’ connection to Meobank’s mission.

Dans un monde où chaque choix compte, Meobank aide les utilisateurs à prendre des décisions financières qui contribuent à un avenir plus vert.

Process

Define

During these interviews, we identified several recurring pain points:

These insights helped us clearly define the problem: young adults need a flexible, easy-to-use financial management solution that addresses the complexity of shared expenses and offers a comprehensive view of their spending habits.

-

Tracking shared payments, especially in shared housing or group outings.

-

Managing online subscriptions efficiently.

-

Gaining better control over daily expenses.

Ideate

Based on the feedback from our research, we brainstormed and designed features tailored to the specific needs of our target audience.

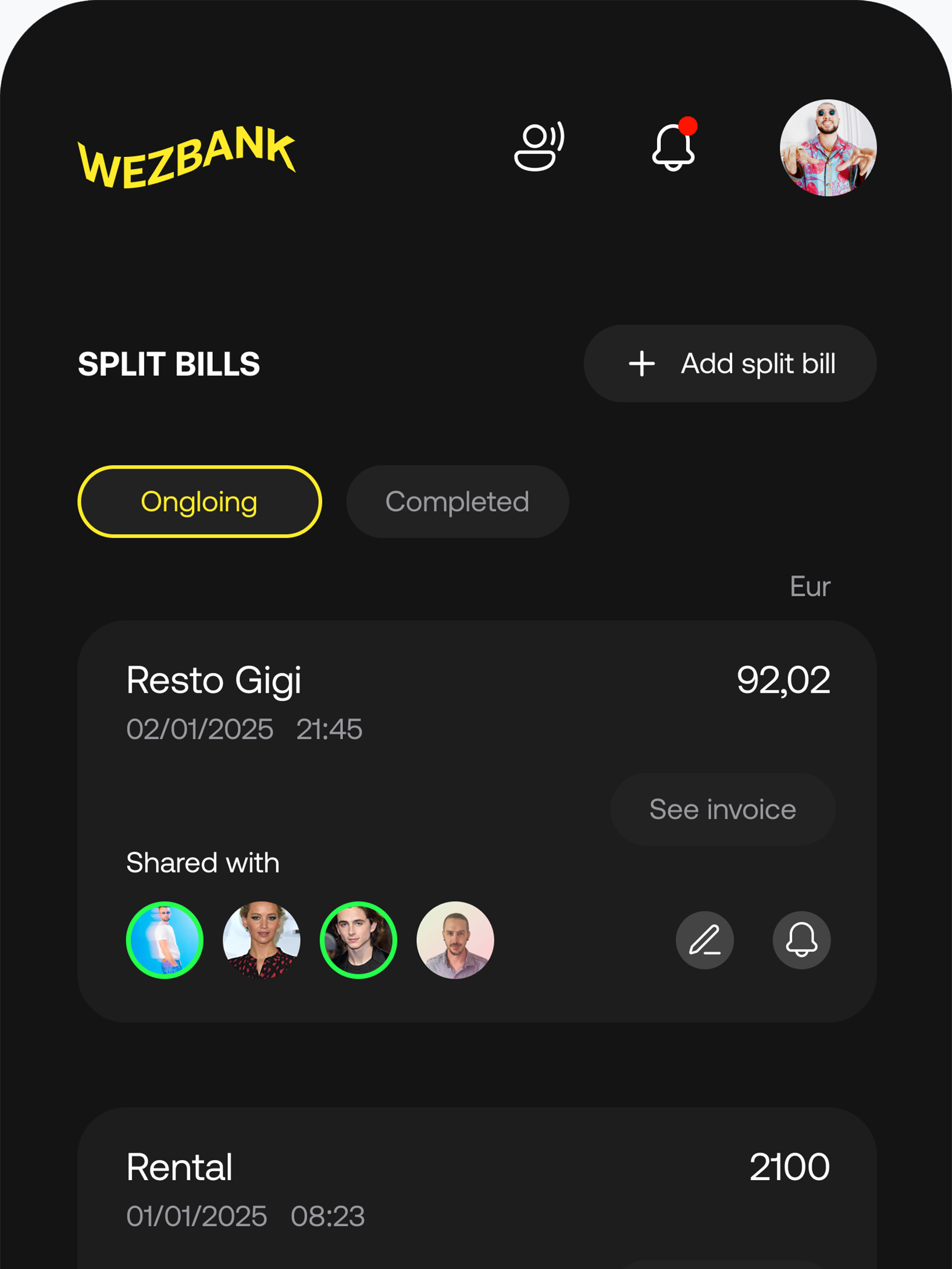

Bill splitting

A feature that simplifies expense sharing by tracking who has paid and sending reminders to those who haven’t.

Virtual cards

The ability to create secure, temporary cards with adjustable spending limits for online purchases.

Customizable dashboard

A flexible interface that allows users to add their favorite contacts and frequently used features for easy access.

AI voice assistance

An intelligent voice chatbot that offers personalized financial assistance and guidance.

Online subscription management

A tool that gives users a clear overview of their active subscriptions with the ability to cancel them at any time.

Voice messages for payments

A unique feature that allows users to leave a voice message when making a payment, adding a personal touch to transactions.

Empathize

We conducted interviews and surveys with young adults to better understand their specific needs and expectations regarding banking services. These discussions revealed significant frustrations with traditional banking apps, often seen as too rigid and poorly adapted to their modern lifestyle.

Users expressed a strong need for flexibility and simplicity in managing their finances. They were looking for a solution that seamlessly integrates into their daily lives, giving them better control over their spending and the ability to adapt to various social and professional situations.

The agile bank

for modern living

Process

User-centered design process

→ User research

We began by conducting in-depth research to understand the needs and expectations of our potential users. This included surveys and interviews that provided crucial insights into the behaviors, motivations, and concerns of future users. This research was fundamental in shaping our design strategy.

→ Persona development

Detailed personas were created to represent our diverse potential user base. Each persona reflects unique banking needs and specific environmental aspirations, ensuring that the application will cater to a wide range of users.

Process

Collaborative use of the Project Canvas

We started by fully utilizing the Project Canvas as a team. This tool allowed us to map out the key objectives of the project, such as integrating AI and gamification to promote sustainability. By visualizing each component together, we ensured a common understanding among all stakeholders and established a clear roadmap for developing this new application.

Project initiation

Precise definition of objectives and constraints

We established SMART goals. For example, aiming to increase user engagement by 30% within the first six months post-launch through gamification features. We identified current budgetary and technical constraints, including challenges related to banking security and AI integration, and planned solutions to overcome them.

Team creation of detailed personas

We conducted surveys, in-depth interviews, and direct observations to gather rich data. This allowed us to develop representative personas, such as Arthur C., 29 years old, an environmentally conscious architect who wants a banking app aligned with his ecological values and offering AI features for better financial management.

User research

Synthesis with the UCD Canvas

We synthesized the information in the UCD Canvas to draw deep insights into the motivations and frustrations of potential users. These insights revealed needs such as visualizing the environmental impact of transactions and the desire for rewards for sustainable behaviors, thereby guiding our design towards truly user-centered solutions.

Collaborative documentation of hypotheses

We recorded UX hypotheses such as “Users will increase their use of the app if gamification elements are integrated.” Each hypothesis was associated with measurable validation criteria, such as retention rate or number of daily interactions, for precise evaluation during future tests.

Formulation and validation of UX hypotheses methodologies

Process

Prototype

Wireframes and interactive prototypes were developed based on the key features identified during the ideation phase.

The prototypes were designed to reflect the simplicity and flexibility requested by the users, ensuring a seamless and intuitive experience.

These prototypes were then shared with our target audience for testing and feedback.

Test

Regular user testing sessions were conducted to evaluate the usability and effectiveness of the prototypes.

These sessions provided valuable feedback, which helped us refine the interface and improve the overall user experience.

Specific areas of improvement included:

• The ease of customizing the dashboard.

• The simplicity of creating and managing virtual cards.

• The smoothness and efficiency of the AI voice assistant.

Through these iterations, we ensured that the final product would meet the expectations and needs of the users while offering an intuitive, flexible, and secure solution.

Arnaud, 21 years old, single

Jules is a student living in shared housing with two friends. With a tight budget, he has to manage rent, groceries, outings, and multiple subscriptions (Netflix, Spotify, etc.). He struggles to keep track of shared payments and manage his subscriptions. Cautious with his online purchases, he looks for secure ways to stay within his budget.

What he said

“Managing my finances is stressful, especially with shared expenses. I want a simple and secure app to split bills and track my online subscriptions. I need a flexible tool that helps me stay in control.”

Methodical evaluation of methods

We used a decision matrix to select the most appropriate methodologies, such as Design Thinking to foster innovation and Lean UX for rapid iterations. We also integrated co-design techniques with users to ensure that the solutions truly meet their needs.

Strategic selection of UX/UI methodologies

Coherent integration into the project canvas

All methodological decisions were documented and integrated into the Project Canvas, ensuring complete transparency and facilitating interdisciplinary communication. This ensured that every team member was aligned on the chosen approaches and their justifications.

Development of a visual design

Drawing inspiration from the latest trends in sustainable design, we created moodboards incorporating natural elements and color palettes evoking serenity and trust. We defined detailed style guides covering typography, iconography, and animations to ensure visual consistency and a smooth user experience.

User interface and information architecture design

Creation of high-fidelity prototypes

Building upon the wireframes and information architecture, we transformed them into interactive high-fidelity prototypes using Figma. These prototypes simulate a realistic user experience, integrating features like carbon footprint tracking and gamification rewards.

Design of Information architecture and creation of wireframes

We structured the application’s content and navigation by developing a comprehensive information architecture. This involved creating sitemaps and user flow diagrams to ensure logical navigation paths. We then developed wireframes based on this structure, laying out the placement of content, features, and interactive elements.

Development of functional prototypes

We are currently working on complex interactive prototypes allowing users to navigate through different features, such as consulting their personal eco-barometer or engaging in spending reduction challenges. These prototypes serve as valuable tools for gathering feedback from users and stakeholders.

Interactive and iterative prototyping

Continuous validation and optimization

By organizing planned user testing sessions, we aim to collect qualitative and quantitative data on interaction with the prototype. For example, determining if users desire easier access to sustainable investment recommendations, which will lead to adjustments in navigation and the highlighting of these features.

Planning qualitative and quantitative user tests

We are preparing structured user tests using realistic scenarios to evaluate the application’s effectiveness. Methods such as “think aloud” will help understand users’ thought processes, while metrics like task success rate will provide quantitative data to measure usability.

User testing

Iterations based on concrete data

The insights obtained will serve targeted iterations. For example, improving the clarity of information on environmental impact to increase user understanding, according to test feedback.

Compliance with WCAG 2.1 AA standards

We ensure that every element of the application under development complies with accessibility standards. This includes using adequate color contrasts, implementing alternative text for images, and ensuring that the application is fully navigable via keyboard.

Advanced accessibility optimization

Active promotion of inclusivity

By integrating universal design principles, we aim to create an application that not only meets accessibility standards but also offers an enriching experience for all users. This reinforces Meobank’s commitment to an ethical and responsible approach.

Collaborative workshops and precise documentation

We organize co-creation workshops with developers to ensure mutual understanding of technical requirements and design intentions. We provide detailed specifications, implementation guides, and exportable resources to facilitate the ongoing development process.

Close collaboration with developers

Monitoring and support during development

We maintain constant communication with the development team, using project management tools like Jira to track progress and quickly resolve issues. This collaboration allows for seamless integration of AI and gamification features without compromising performance or security.

Methodical Evaluation of Methods as a Team

We used a decision matrix to select the most appropriate methodologies, such as Design Thinking to foster innovation and Lean UX for rapid iterations. We also integrated co-design techniques with users to ensure that the solutions truly meet their needs.

→ Strategic selection of UX/UI methodologies

Coherent Integration into the Project Canvas

All methodological decisions were documented and integrated into the Project Canvas, ensuring complete transparency and facilitating interdisciplinary communication. This ensured that every team member was aligned on the chosen approaches and their justifications.

→ User interface design

-

Development of a visual design in collaboration

Drawing inspiration from the latest trends in sustainable design, we created moodboards incorporating natural elements and color palettes evoking serenity and trust. We defined detailed style guides covering typography, iconography, and animations to ensure visual consistency and a smooth user experience.

-

Creation of wireframes and high-fidelity prototypes

We used Figma to develop structured wireframes and then transformed them into high-fidelity interactive prototypes. These prototypes integrate micro-interactions and smooth transitions to simulate a realistic user experience, including features like carbon footprint tracking and gamification rewards.

→ Interactive and iterative prototyping

-

Development of functional prototypes

We are currently working on interactive prototypes allowing users to navigate through different features, such as consulting their personal eco-barometer or engaging in spending reduction challenges. These prototypes serve as valuable tools for gathering feedback from users and stakeholders.

-

Continuous validation and optimization

By organizing planned user testing sessions, we aim to collect qualitative and quantitative data on interaction with the prototype. For example, determining if users desire easier access to sustainable investment recommendations, which will lead to adjustments in navigation and the highlighting of these features.

→ User testing

-

Planning qualitative and quantitative user tests

We are preparing structured user tests using realistic scenarios to evaluate the application’s effectiveness. Methods such as “think aloud” will help understand users’ thought processes, while metrics like task success rate will provide quantitative data to measure usability.

-

Iterations based on concrete data

The insights obtained will serve targeted iterations.

→ Close collaboration with developers

-

Collaborative workshops and documentation

We organize co-creation workshops with developers to ensure mutual understanding of technical requirements and design intentions. We provide detailed specifications, implementation guides, and exportable resources to facilitate the ongoing development process.

-

Monitoring and support during development

We maintain constant communication with the development team, using project management tools like Jira to track progress and quickly resolve issues. This collaboration allows for seamless integration of AI and gamification features without compromising performance or security.

→ Advanced accessibility optimization

-

Compliance with WCAG 2.1 AA standards

We ensure that every element of the application under development complies with accessibility standards. This includes using adequate color contrasts, implementing alternative text for images, and ensuring that the application is fully navigable via keyboard.

-

Active promotion of inclusivity

By integrating universal design principles, we aim to create an application that not only meets accessibility standards but also offers an enriching experience for all users. This reinforces Meobank’s commitment to an ethical and responsible approach.

→ Information architecture

With our personas in mind, we mapped out clear user flows and a comprehensive site map to define the structure of the application. This step is crucial to ensure the app will be both intuitive and easy to navigate. future users. This research was fundamental in shaping our design strategy.

→ Wireframes and prototypes

The information architecture was translated into wireframes, which are currently being developed into high-fidelity interactive prototypes. These prototypes serve as a visual representation of the app’s functionality and design.

→ Usability testing

Although the application is still in development, we have planned rigorous usability testing, where future users will interact with the prototypes. These tests will provide valuable feedback and enable iterative improvements before the official launch.

Key Features of AI

AI plays a key role in improving financial management at Meobank by integrating features focused on sustainability and environmental impact. These innovations help guide users toward more responsible choices.

Personalized financial advice

Tailored to each user’s spending habits and their environmental impact, helping them make eco-friendly financial decisions.

Real-time carbon footprint tracking

Providing users with insights into the environmental impact of their transactions and suggesting ways to reduce or offset their carbon footprint.

Green rewards programs

Identifies and promotes eco-friendly businesses, rewarding users for sustainable choices with points or incentives.

Sustainable investment portfolios

Analyzes user preferences and market data to recommend investment options aligned with environmental sustainability goals.

Eco-friendly chatbots

Chatbots assist with banking tasks and offer advice on sustainable living and financial management.

Predictive sustainable savings

Evaluates savings patterns and suggests sustainable projects, such as investments in renewable energy, that users can contribute to.

Fraud detection with a focus on greenwashing

Ensures that companies and products claiming to be sustainable are accurately represented, maintaining trust and transparency.

Community engagement

Connects users with similar sustainability goals, fostering a community of environmentally conscious individual.

Optimization of green loans and credits

Assesses loan applications based on sustainability criteria, offering better terms for eco-friendly projects.

Gamification to engage users

Gamification for enhanced user engagement and sustainability, making the banking experience more interactive and enjoyable.

Personalized goals

Allow users to set specific sustainability-related goals, such as saving for an eco-friendly purchase or reducing their carbon footprint. They can earn points or badges when they achieve these goals.

Virtual tree

Each time a user completes a sustainable action (such as making an eco-conscious purchase or reducing their carbon footprint), a virtual tree grows in the app. Once the tree is fully grown, the user can unlock rewards or even plant a real tree through a partnership with an environmental organization.

Personal eco-barometer

A visual indicator within the app shows in real-time how users’ financial actions positively impact the environment. As they make more sustainable decisions, the barometer rises, unlocking rewards.

Leaderboards and rewards

Introduce a leaderboard for users most engaged in sustainable financial practices. Top users can earn badges, virtual rewards, or even special offers from eco-friendly partners.

Spending reduction challenges

Offer challenges where users aim to cut non-essential spending over a set period. The savings can be invested in green projects, with rewards for those who succeed.

Energy savings tracker

Allow users to connect the app to their utility accounts to track energy consumption. Users can earn points by reducing their energy use over time.

Carbon footprint reduction badges

Reward users with special badges when they reach milestones in reducing their carbon footprint, such as driving less or purchasing locally produced goods.

“Buy sustainable” challenges

Implement challenges where users are encouraged to purchase products labeled as sustainable or organic. By scanning receipts through the app, they can accumulate points for rewards or donations to environmental causes.

What Sets Us Apart

Next steps

We will focus on completing the development of the app’s core features, expanding AI-driven functionalities, and continuously improving the user experience based on ongoing testing and feedback. Additionally, we plan to explore additional features to increase user engagement and retention as the app approaches its launch.

Challenges and solutions

User engagement

One of the most significant challenges we currently face is ensuring high user engagement. To achieve this, we are working on creating an interface that is both functional and emotionally engaging. The design must reflect sustainability values, allowing users to feel connected to the app and its ecological objectives.

Balance between simplicity and functionality

We face the challenge of designing an app that is both simple and powerful. Our approach is to adopt a minimalist design, removing non-essential elements to focus on what truly matters: ease of use, security, and the integration of sustainability values. We are currently fine-tuning this balance to deliver a smooth experience without sacrificing performance.

Security issues

As a banking application, security has been a top priority from the earliest stages of the project. We are currently implementing security features that comply with industry standards while ensuring that these measures do not compromise the user experience. The goal is to offer a secure and intuitive app that inspires trust.

AI integration challenges

The integration of AI presents both technical and usability challenges, particularly in ensuring that AI-driven features provide real value without overwhelming users. We are addressing these challenges by implementing transparent systems and giving users control over how AI influences their experience.

Gamification challenges

Integrating gamification into the application presents specific challenges. We need to encourage responsible financial behavior while aligning these actions with the app’s sustainability values. The challenge is to make gamification engaging without being intrusive or distracting from the core banking features. To address this, we are taking a subtle approach to gamification, focusing on elements that add value without overwhelming the user.

What Sets Us Apart

What will the

product look like?

The app will feature a clean, intuitive design that reflects its core values of simplicity, responsibility, and eco-consciousness. Users will be greeted with a user-friendly interface that highlights their financial health while providing clear insights into their carbon footprint. Key features such as personalized AI-driven recommendations, gamification elements like challenges and rewards for sustainable actions, and real-time tracking of eco-friendly spending will be seamlessly integrated.

The app will use visually engaging tools like graphs and interactive dashboards to help users easily monitor their environmental impact. With a modern design that prioritizes both functionality and sustainability, the app will make it effortless for users to align their financial goals with their environmental values.

Final product features

The app will feature a clean, intuitive design that reflects its core values of simplicity, responsibility, and eco-consciousness. Users will be greeted with a user-friendly interface that highlights their financial health while providing clear insights into their carbon footprint. Key features such as personalized AI-driven recommendations, gamification elements like challenges and rewards for sustainable actions, and real-time tracking of eco-friendly spending will be seamlessly integrated.

The app will use visually engaging tools like graphs and interactive dashboards to help users easily monitor their environmental impact. With a modern design that prioritizes both functionality and sustainability, the app will make it effortless for users to align their financial goals with their environmental values.

Voice messages for payments

One of WezBank’s most innovative and differentiating features is the ability to send voice messages during payments. This option, which allows users to leave a voice message instead of simply writing a text, has been particularly well-received by users who want to make their transactions more personal.

For example, they can thank a friend or add a warmer note during a payment. This feature, still rare in current banking apps, helps reinforce the human aspect of financial exchanges, distinguishing WezBank from other solutions on the market.

Flexibility

One of WezBank’s most appreciated features is the management of virtual cards. Users can create cards temporarily for specific purchases, set spending limits, and block or unblock the cards as needed.

This level of control allows them to secure their online payments and avoid overcharges or fraud. This kind of flexibility is rarely found in other banking apps, making WezBank particularly competitive in this area.

Personalization

The customizable dashboard is another highly appreciated aspect by users. They can organize their interface based on their habits, adding shortcuts to their most frequent contacts, quickly accessing the features they use most (such as payments or bill splitting), and maintaining a clear overview of their subscriptions.

This flexibility helps users save time and avoid navigating through complex or cluttered menus. Users appreciate being able to tailor the interface to their preferences, creating a much more intuitive and enjoyable experience.

AI assistance

The integration of the AI-powered voice chatbot was well received. This chatbot, capable of answering questions and guiding users through transactions, greatly simplifies the banking experience. Instead of manually navigating through the app, users can interact naturally with the chatbot, making the interaction less formal and more accessible.

This type of assistance not only reduces the stress of managing finances but also creates a more user-friendly and engaging environment.

Result

WezBank is still in the development phase, but early user feedback has been very promising. The app has captured attention thanks to its unique combination of flexibility, personalization, and technological innovation, which greatly simplifies financial management for young adults.

Here are the key strengths that emerged from user testing:

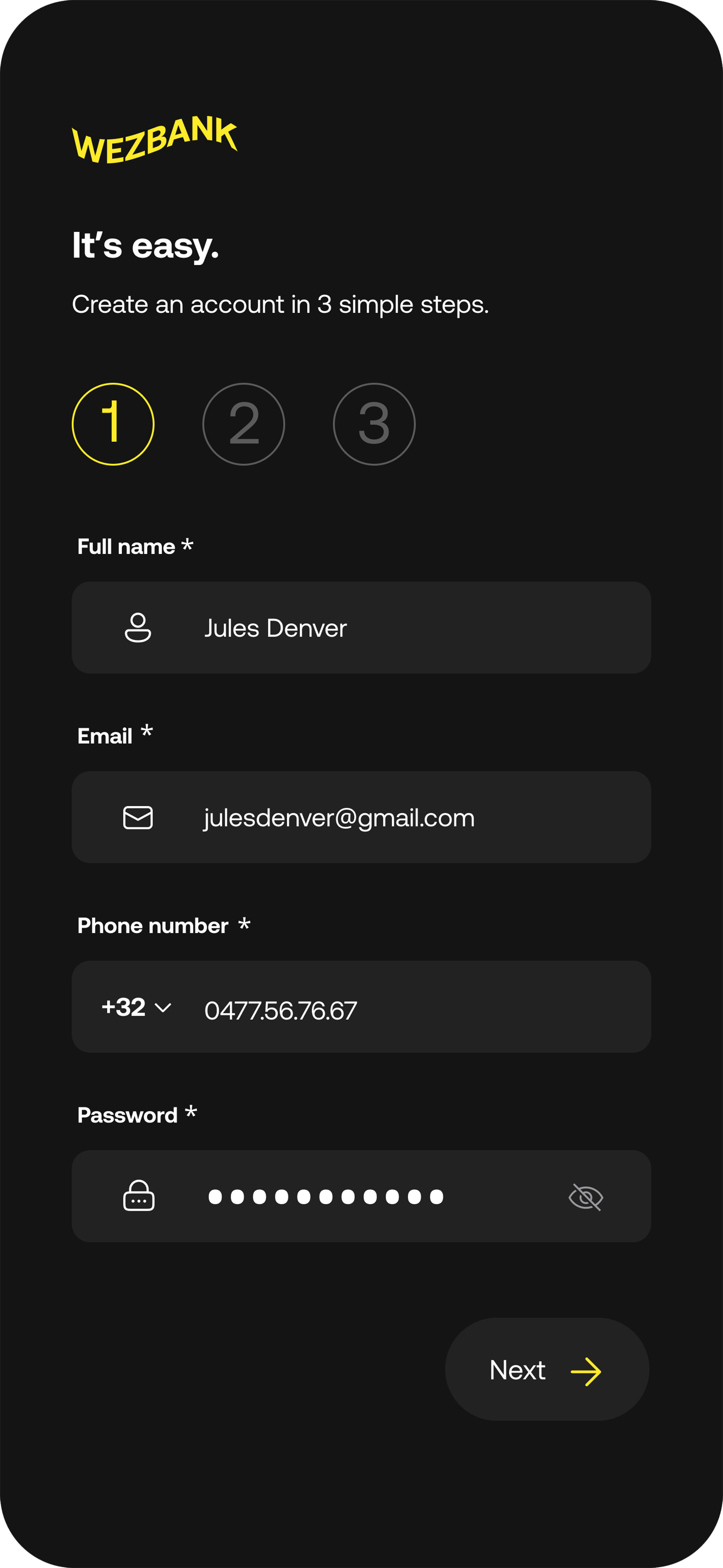

Easy, simple, and secure

Creating an account on WezBank is quick and hassle-free, ensuring a smooth and safe onboarding experience. Once registered, users can securely access their account using a passcode or Face ID.

Wezy, the AI voice assistant

A smart voice assistant that provides personalized financial guidance and support, helping users manage their finances more efficiently and offering tailored advice based on their needs.

Split bills

Easily share expenses and track who has paid, all in just a few clicks, hassle-free.

Customize your home screen for instant actions

Personalize your home screen by adding shortcuts to your most-used actions, giving you quick and easy access to your favorite features in just one tap.

Virtual cards

Create secure, temporary virtual cards for online purchases. Set spending limits, block overcharges, and pause or close cards anytime for flexible and safe transactions.

Manage your contacts easily

Quickly access your favorite contacts or browse through all your saved ones. Easily add new contacts and make payments smoother with just a few taps.

Voice messages for payments

Make your transactions more personal by sending a voice message with your payments. Whether you’re paying a friend or splitting a bill, you can choose to leave a voice message instead of typing, adding a personal touch to every transaction.

Overview of your financial activity

Get a clear view of your recent payments and account balance.